The tax implications of selecting between FIFO and LIFO stock accounting strategies are profound and may considerably affect an organization’s monetary technique. Beneath FIFO, the price of items bought is mostly decrease in periods of inflation, resulting in larger taxable revenue. This may end up in a bigger tax legal responsibility, which might not be superb for corporations trying to decrease their tax burden.

Variations Between FIFO and LIFO

The selection between FIFO and LIFO stock accounting strategies can form an organization’s monetary panorama in distinctive methods. FIFO, or First-In, First-Out, assumes that the oldest stock gadgets are bought first. This methodology typically aligns extra intently with the precise bodily circulation of products, particularly for perishable gadgets. By promoting older inventory first, companies can decrease the chance of obsolescence and spoilage, which is especially useful for industries like meals and prescribed drugs. It’s as much as the corporate to determine, although there are parameters primarily based on the accounting methodology the corporate makes use of.

Observe and handle time

Kari Downs, an auditor with Wheeler CPAs, is performing a evaluate of Depue Firm’s stock account. Depue didn’t have an excellent 12 months, and prime administration is beneath stress to…

FIFO vs. LIFO: Monetary and Tax Impacts Defined

No, the LIFO stock methodology is just not permitted beneath Worldwide Monetary Reporting Requirements (IFRS). Consequently, LIFO is not sensible for a lot of corporations that promote perishable items and does not precisely replicate the logical manufacturing technique of utilizing the oldest stock first. However in most international locations, the IFRS normal is enforced beneath which utilizing LIFO is just not allowed.

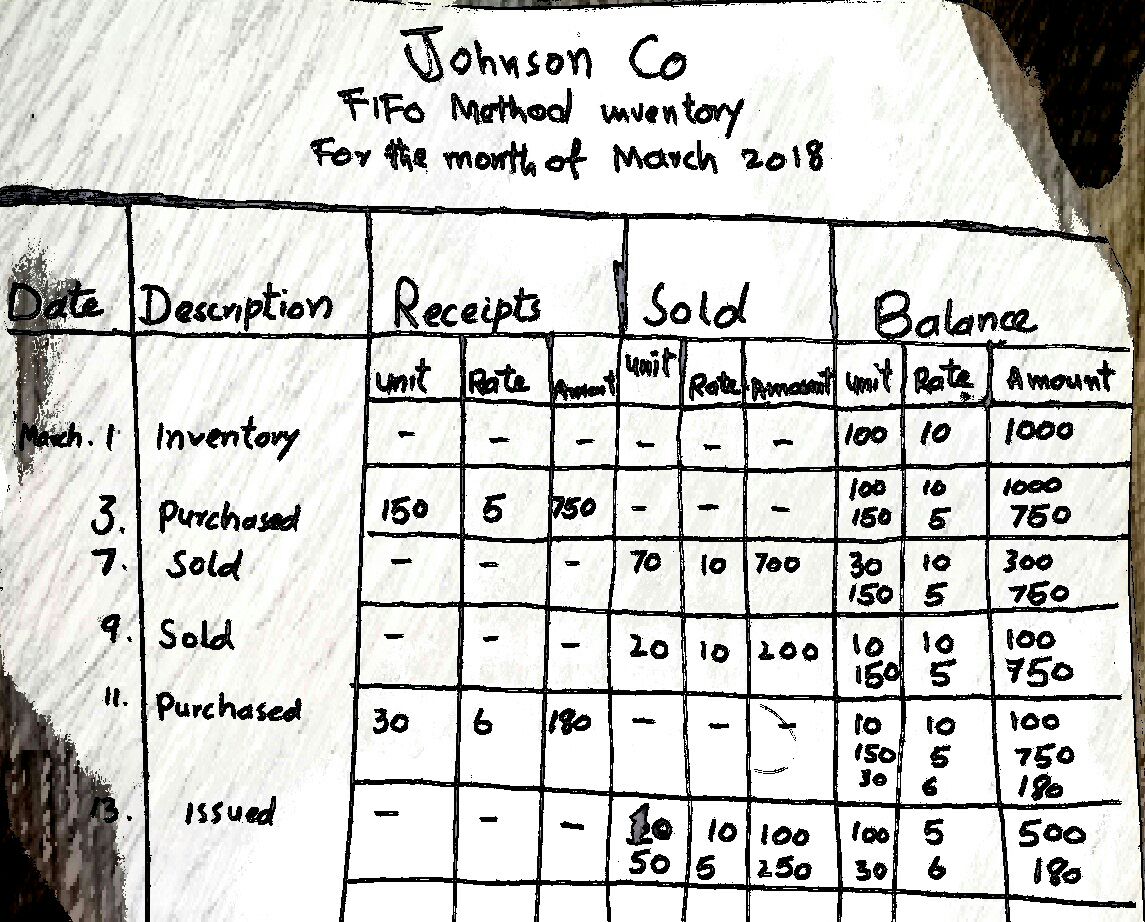

Specialties embody basic monetary planning, profession growth, lending, retirement, tax preparation, and credit score. However since inflation is a actuality, the stock worth comes out to be one thing once we use FIFO, and it comes out to be one thing else once we use LIFO. Contemplate the small print concerning the three batches of manufacturing given within the above desk.

How Does LIFO and FIFO Affect Internet Earnings?

Utilizing FIFO simplifies the accounting course of as a result of the oldest gadgets in stock are assumed to be bought first. When Sterling makes use of FIFO, all the $50 items are bought first, adopted by the gadgets at $54. On this case, the shop sells 100 of the $50 items and 20 of the $54 items, and the price of items bought totals $6,080. Let’s assume {that a} sporting items retailer begins ocean metropolis md wine bar and bistro restaurant liquid property the month of April with 50 baseball gloves in stock and purchases a further 200 gloves. Items obtainable on the market totals 250 gloves, and the gloves are both bought (added to value of products bought) or stay in ending stock. If the retailer sells 120 gloves in April, ending stock is (250 items obtainable on the market – 120 value of products bought), or 130 gloves.

FIFO additionally means the 20 items remaining in stock had the newest value of $46 every for a complete of $920. Since LIFO makes use of probably the most not too long ago acquired stock to worth COGS, the leftover stock may be extraordinarily outdated or out of date. Consequently, LIFO doesn’t present an correct or up-to-date worth of stock as a result of the valuation is way decrease than stock gadgets at in the present day’s costs. Additionally, LIFO is just not reasonable for a lot of corporations as a result of they might not depart their older stock sitting idle in inventory whereas utilizing probably the most not too long ago acquired stock. Later within the day, you ask the bookkeeper for the bill on the carload and the associated freight invoice. Companies would use the LIFO methodology to assist them higher match their present prices with their income.

Because the costs of stock have been lowering, the LIFO reserve should have been lowering as nicely. Additional, because the firm has been reporting a value of gross sales decrease than the precise substitute value, because of value decreases, the corporate’s value of gross sales has been underestimated. To make a correct estimation of Xtractor’s value of gross sales, the quantity of lower of the LIFO reserve must be added to the price of gross sales. If the LIFO reserve decreases throughout a reporting interval, the lower within the reserve must be added to the price of the gross sales quantity which is reported on the revenue assertion. Additionally, by way of matching decrease value stock with income, the FIFO methodology can decrease a enterprise’ tax legal responsibility when costs are declining.

- The shop’s ending stock steadiness is 30 of the $54 items plus 100 of the $50 items, for a complete of $6,620.

- On the steadiness sheet, FIFO usually ends in larger stock values.

- You additionally want to know the regulatory and tax points associated to stock valuation.FIFO is the extra easy methodology to make use of, and most companies keep on with the FIFO methodology.

- The selection between FIFO and LIFO stock accounting strategies can form an organization’s monetary panorama in distinctive methods.

Houghton Restricted is attempting to find out the worth of its ending stock as of February 28, 109, the corporate’s year-end. The next transactions occurred and the accountant requested your assist… For the previous 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, supervisor, advisor, college teacher, and innovator in educating accounting on-line.

In the event you function a retailer, producer, or wholesale enterprise, stock could require a big funding, and it’s essential monitor the stock steadiness rigorously. Managing stock requires the proprietor to assign a price to every stock merchandise, and the 2 most typical accounting strategies are FIFO and LIFO. The FIFO vs. LIFO accounting choice issues due to the truth that stock value recognition immediately impacts an organization’s present interval value of products bought (COGS) and internet revenue. Assuming that costs are rising, which means that stock ranges are going to be highest as the newest items (typically the most costly) are being saved in stock. This additionally implies that the earliest items (typically the least costly) are reported beneath the price of items bought.